Products you buy through our links may earn us a commission. Oh, and if something's out of stock, oops, it was there (and all prices were accurate) at time of publication.

Teens have a lot on their plate. Between school, driver’s ed, practice, rehearsals, tutoring — there’s not much room for discussing finances. Enter: Cash App. This easy money app allows for seamless transactions and budget management without the stress (or hidden fees). The best part? Parents can control every part.

Why Parents Love Cash App…

Complete control…Teen accounts on Cash App can only be used with parent approval. Once a teen’s profile has been set up, parents can monitor all account and card activity. They can also designate which features their teen can access, like stocks, cash transactions, Bitcoin, and more.

Push notifications and alerts…Parents get notified whenever their teen sends a payment to a new contact, uses their Cash App card, or makes deposits.

Zero monthly fees or minimum balance…This one speaks for itself, but unlike other teen banking services, Cash App won’t charge monthly fees, instant transaction fees, or require a minimum balance.

24/7 fraud monitoring and proactive fraud prevention…Teen profiles aren’t searchable within the app to keep their information extremely secure. Cash App will also automatically reject payments they deem to be risky, so you can rest easy.

Why Teens Love Cash App…

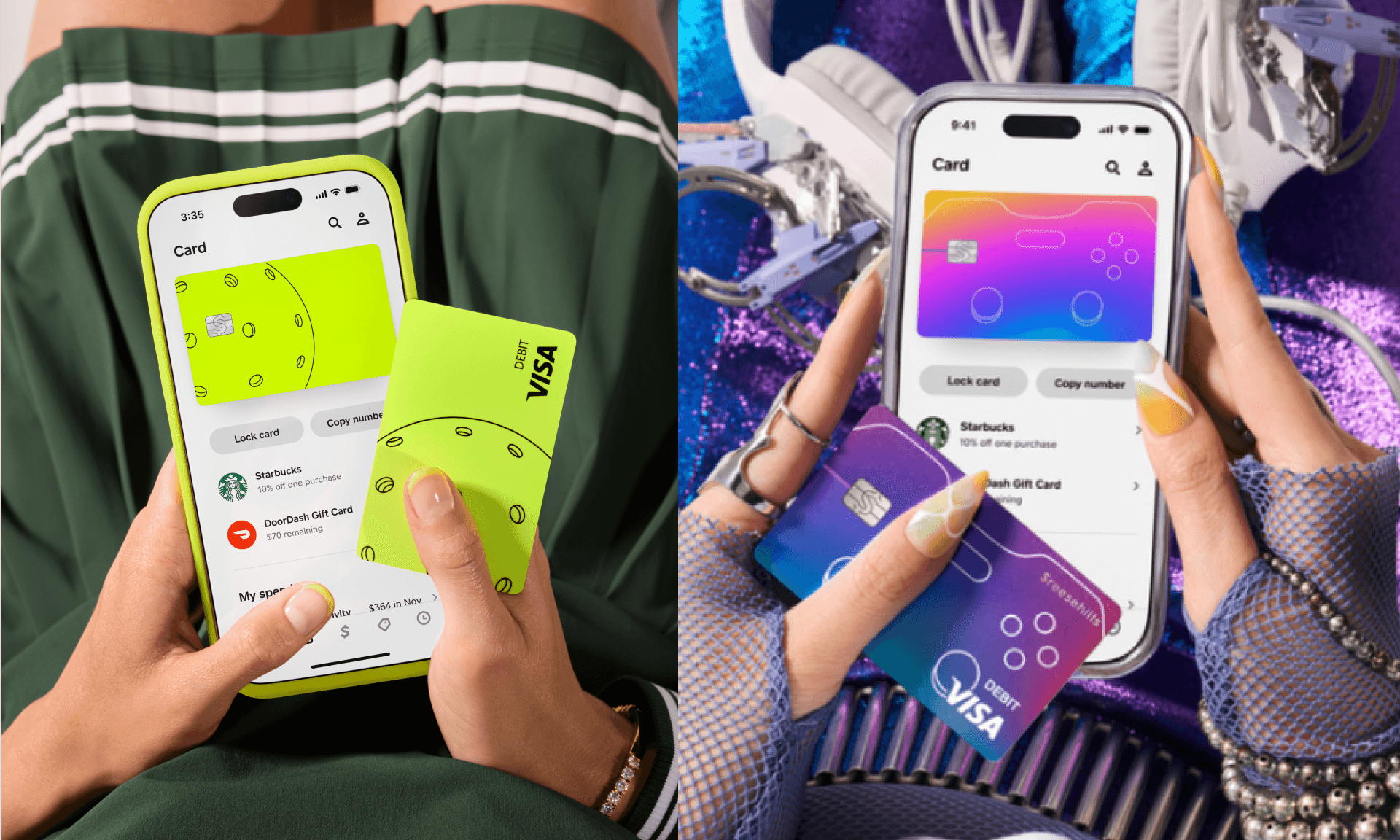

Customizable debit cards…Teens can choose from Cash App’s exclusive card styles, add illustrations or emojis, or even draw on it themselves. The card works anywhere Visa is accepted.

Zero fees to send or receive money instantly… When they say no hidden fees, they mean it. Cash App won’t charge you or your teen when sending or receiving money or making direct deposits.

Built-in beginner-friendly tools for budgeting and saving…Cash App lets you do everything from setting savings goals and spending limits, to investing in the stock market.†

Exclusive deals and savings…Teens can save on everyday spending (like coffee shops, restaurants or clothes) with exclusive offers for Cash App card holders.

Disclaimer: Cash App is a financial services platform, not a bank. Banking services provided by Cash App’s bank partner(s). Prepaid debit cards issued by Sutton Bank, Member FDIC. See Terms and Conditions. Direct Deposit and Offers provided by Cash App, a Block, Inc. brand.To view the eligibility requirements for sponsoring a teen, please visit the Sponsored Accounts section of the Cash App Terms of Service.

†Brokerage services provided by Cash App Investing LLC, member FINRA/SIPC, subsidiary of Block, Inc. Bitcoin services are not licensable activity in all U.S. states and territories. Block, Inc. operates in New York as Block of Delaware and is licensed to engage in virtual currency business activity by the New York State Department of Financial Services. Investing and bitcoin are non-deposit, non-bank products that are not FDIC insured and involve risk, including monetary loss. Cash App Investing does not trade bitcoin and Block, Inc. is not a member of FINRA or SIPC. For additional information, see the Bitcoin and Cash App Investing disclosures. Additional fees for securities may apply such as regulatory fees and fees to transfer securities externally. Please see our House Rules for more information.

Live Smarter

Sign up for the Daily Skimm email newsletter. Delivered to your inbox every morning and prepares you for your day in minutes.