Happy Friday.

Jobs alert: If you're looking to make a change, submit your resume to #HIREBLACK's Mega Resume Drop, and connect with recruiters and hiring managers at Amazon Design, Condé Nast, Greenhouse Software, theSkimm (oh, hey), and more. Then get a ticket for next weekend's 2021 #HIREBLACK Summit with the code THESKIMM for 30% off. As for this week…

Headlines, Skimm'd

Taxing matters. There’s been a lot of tax talk this week in Congress. One pitch that went nowhere fast would've added capital gains taxes on unsold investments (vs. current rules that only tax assets sold for a profit) for the wealthiest Americans. Good for the likes of Elon Musk, who was not a fan. Still on the table: surtaxes on individual incomes above $10 million and a 15% minimum tax on US corporations with three straight years of $1 billion in profits.

Traffic jam. Despite hoping to pass a bill last month, lawmakers continue to negotiate on an infrastructure package. Along with a "new" $1.75 trillion additional spending bill (partially paid for by the above tax plans) that would invest in education, health care, affordable housing, and racial equity. But not paid leave.

Tesla pulls up. The company is now valued at more than $1 trillion, making it the sixth US biz to hit the milestone and worth more than the world's 11 largest carmakers combined. That's thanks in part to Wall Street's interest in electric vehicles. Tesla's stock popped on Tuesday after Hertz agreed to buy 100,000 of its EVs. Psst...since it's a big component of the S&P 500 (an index often used to rep the overall US stock market), you have exposure to TSLA if you own a fund that tracks this index.

News to Wallet

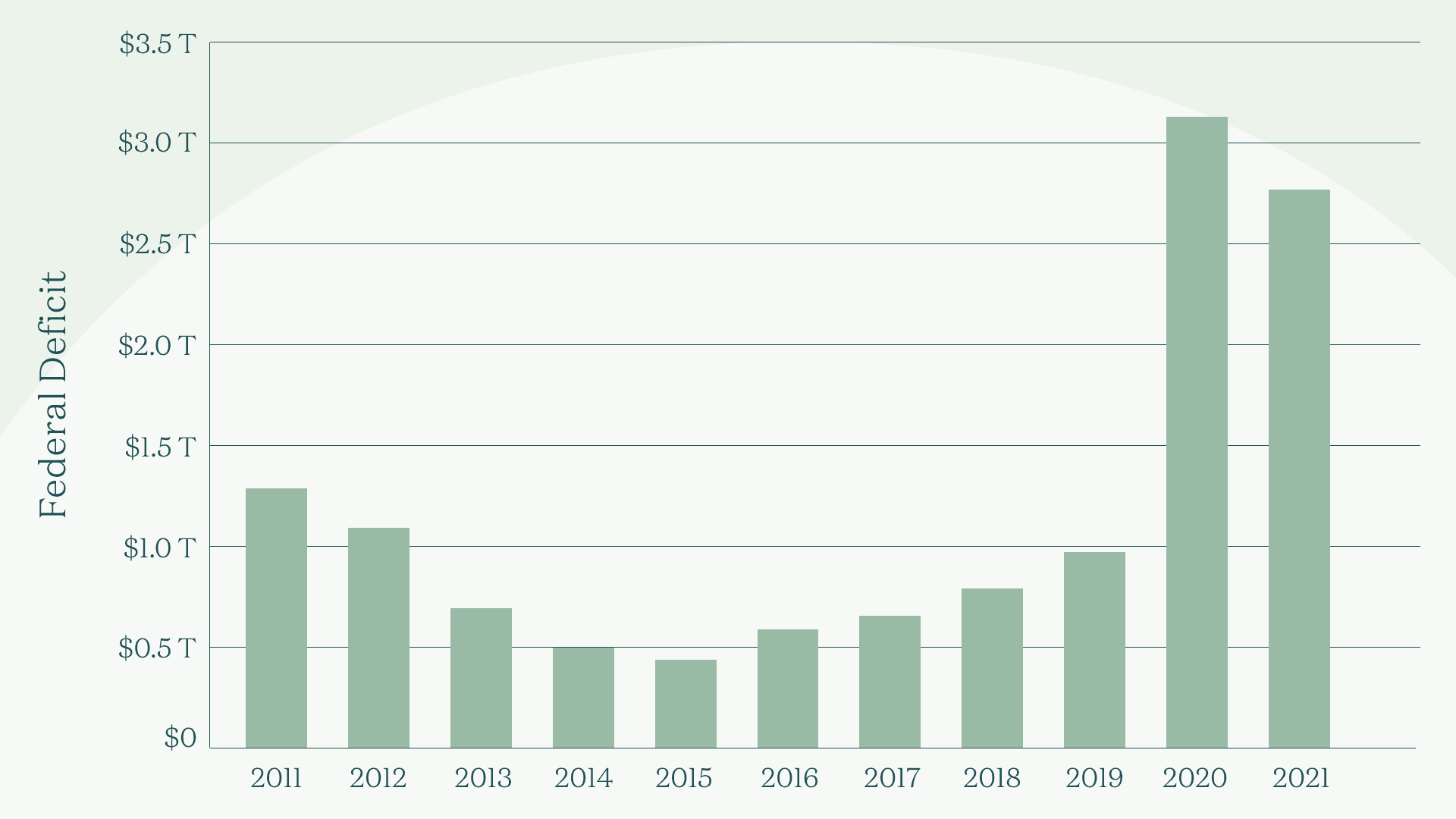

What the Federal Deficit Can Mean for Your Wallet

When Uncle Sam's budget is out of whack, it can affect yours. This year, the federal deficit was the second-highest on record. Lawmakers can try to balance the books by spending less or trying to bring in more money, both of which have ripple effects for Americans. Since you can't put the gov on a budget, here's how to mind yours.

Make Good (Money) Choices

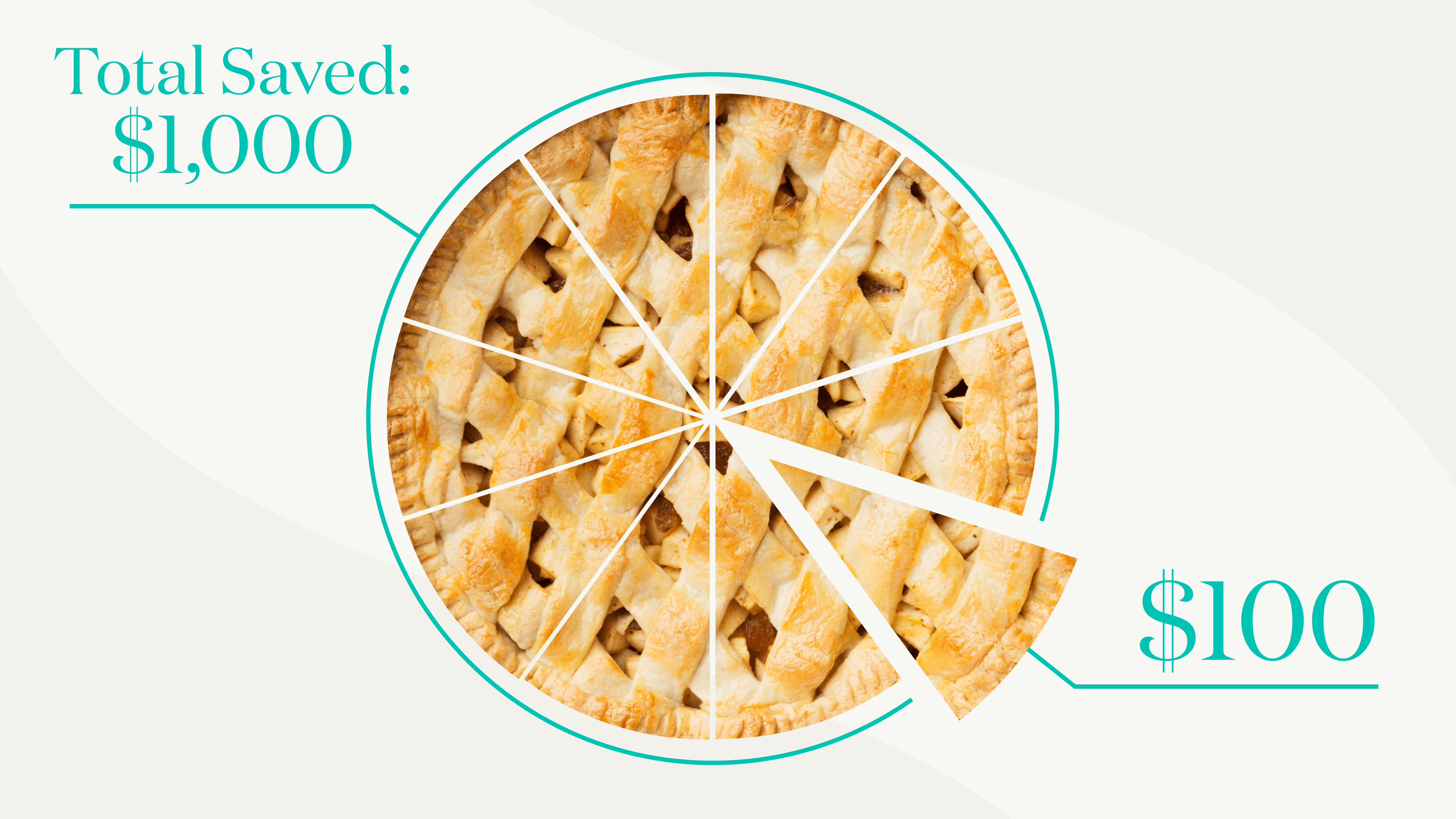

If you've got a big money goal…

Break it down. Whether you're saving for holiday gifts or retirement, a too-big target might intimidate you from ever starting. Research says focusing on smaller goals at first – that you can increase over time – make it easier to get motivated. Example: $100 may not seem like much to some, but start saving that amount every week, and you'll have $1,000 by EOY. Get more tips on setting realistic money goals.

If you want to pick up some extra cash...

Think about a seasonal side gig. Because this could be a particularly good year to snag one. Employers are offering sign-on bonuses and other incentives to attract applicants while the labor market is experiencing major worker shortages. Who's hiring for what? A variety of businesses – from Uncommon Goods to Amazon to Wine.com – are looking for people to work IRL and from their couches. Wine not?

If you've been out of the (career) game...

Plan your next move. One study says two in three women who left the workforce during the pandemic are ready for a comeback. And more than half might switch to a new field, like science, technology, engineering or math. Other in-demand roles include nursing, restaurant workers, fitness instructors, and occupational therapy assistants. A career change doesn't have to mean going back to school. Look into industry-specific certification programs to give you a leg up. Networking can also help get your foot in the door of an industry where you don't have a track record.

Thing to Know

Hyperinflation

Like inflation on too much Halloween candy. It's when prices speed up at a crazy-fast rate (think: 50% a month or more) over time. Which typically only happens during wars and great economic turmoil. (See: Hungary, post WWII, when prices doubled roughly every 15 hours. And Zimbabwe in 2008, when major political changes and a drought contributed to prices doubling about once a day.) The closest thing the US has come to experiencing this was when the annual inflation rate went up to about 30%...in 1778. Last Friday, Twitter and Square CEO Jack Dorsey tweeted "it's happening" soon to the US, and then the world. Why? Maybe to plug crypto (he's a big Bitcoin guy), in case other currencies collapse. But a lot of experts agree this is not a thing to worry about. For context: US inflation was up 5.4% year-over-year in September – a level we haven't seen prior to this summer since 2008.

Hot Off the Web

Facebook – or Meta? – says it's 'not what it looks like' after classified papers detailing possible corruption are leaked.

Meet Janis Bowdler, the US Treasury's first racial equity counselor.

The Doge days are over? Shiba Inu crypto's value rivals Dogecoin.

Portland tells city workers grieving a pregnancy loss (including abortions), 'Take your time and paid leave.'

If you're a struggling renter, billions in aid is still available.

Walmart: where you can buy diapers, a new iPhone, and now crypto (in some locations).

Subscribe to Skimm Money

Your source for the biggest financial headlines and trends, and how they affect your wallet.