Leave the financial planning to the men? I don’t think so. According to a recent survey, women are reportedly closing the financial confidence gap with 55% feeling ‘super’ about their money management abilities (up from 48% two years ago) vs. 60% of men (down slightly from 61%). Overspending isn't on the agenda for hot girl summer.

Headlines, Skimm'd

Econ report. Many experts (and Cardi B) are sounding recession alarms, but economic news this week is a mixed bag. The bad news: Inflation is still high. The Consumer Price Index rose 8.6% in May from a year ago — the fastest increase in more than 40 years. And GDP growth is slowing down. Good news: Some households saw their collective net worth double over the last two years. Unemployment is low at 3.6%. And women’s labor force participation is almost back to pre-pandemic levels.

Making cuts. Layoffs are rippling through the tech industry. Tech startups laid off 17,000 workers last month, the most since 2020, according to one report. Some of the companies laying off employees saw pandemic booms that have since fizzled out. Think: Peloton and Netflix. And several crypto companies are also scaling back amid shaky market conditions. Coinbase recently rescinded job offers and Gemini cut 10% of its staff.

Set up to struggle. Based on data compiled by the National Association of Realtors, rising prices and mortgage rates are driving home affordability down faster than ever. And millennials are already facing a number of obstacles that make it harder to buy homes (hi, student loan debt). So much so that more parents are reportedly helping their adult kids become homeowners. Is “Harry’s House” the only one we can afford?

News to Wallet

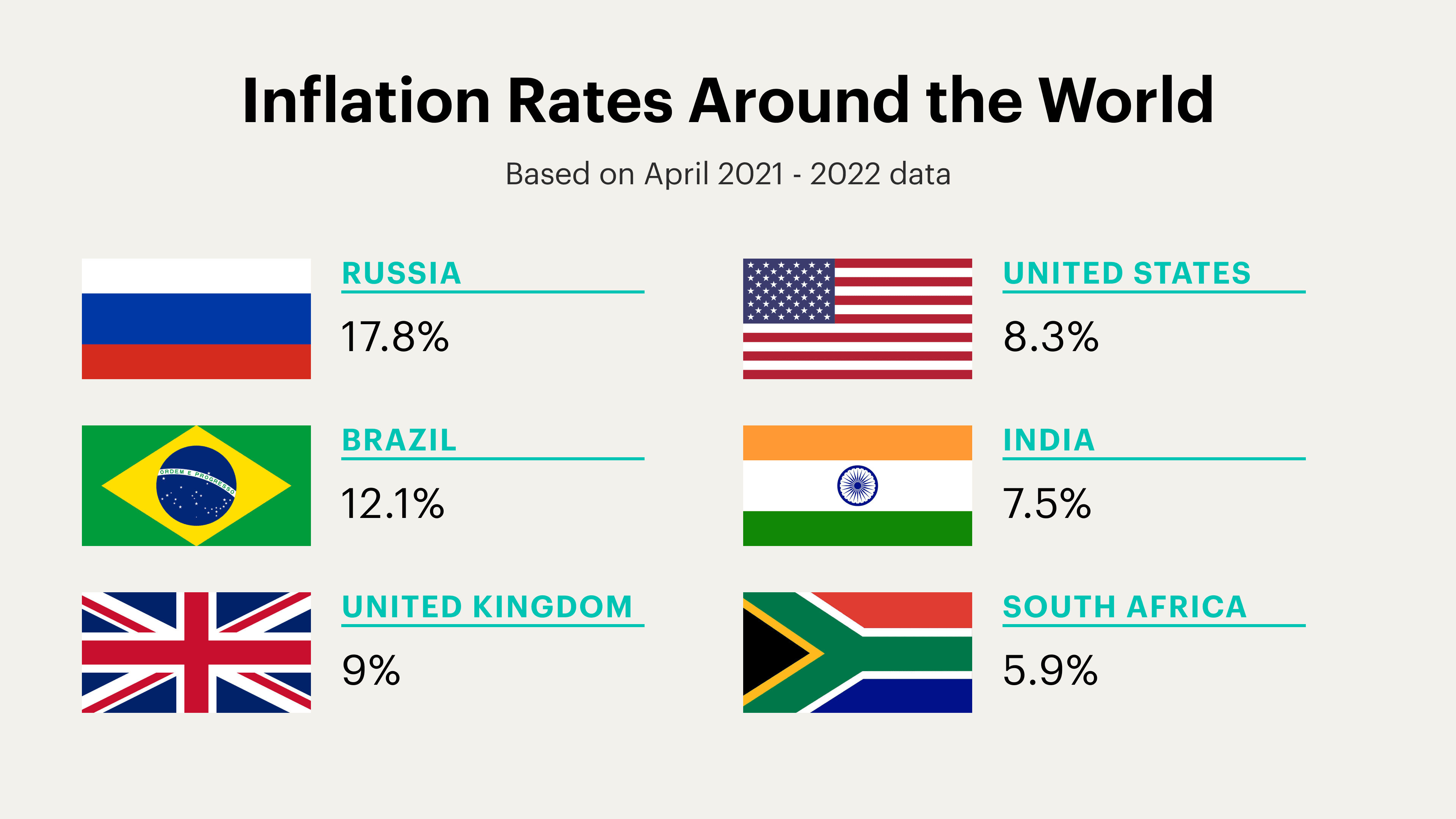

Inflation is high in the US (see above). But it’s not just here. Because global economy. Causes abroad are similar to those in the US: Russia’s war in Ukraine, supply chain disruptions, and climate change, to name a few. Here’s what the inflation situation is in…

India: Inflation is well above the target rate of 4% (psst…the US aims for 2%). In rural areas where poverty rates are already high, increasing food costs are especially problematic.

South Africa:The South African Reserve Bank aims for inflation between 3% and 6%. In April, it sat near that upper limit for the third time in five months. And is on pace to rise to 8% this year.

United Kingdom:The latest inflation rate is at a 40-year high. And causing some fish and chip shops to close because of higher flour, cooking oil, and fish costs.

Your move? Wherever you live, prep for inflation to stick around. And learn more about how it’s impacting the rest of the world, too.

Make Good (Money) Choices

If you’re always counting down to your next paycheck…

Create a monthly budget. Because making more money doesn’t always = financial success. A recent study found that about one in three Americans who earn over $250,000 a year report living paycheck-to-paycheck. (Spoiler: They’re not all struggling. Some can pay their bills easily, while others can’t.) If you're stretching your dollars between paydays, tracking your spending could be key to breaking that cycle. Whether you need every cent to keep up with bills or want to make sure you’re saving enough for retirement, creating a monthly budget can help you keep your spending in check and hit your money goals. Use this template to get started.

Crypto, Decoded

Crypto scammers have stolen more than $1 billion since the start of 2021, according to the Federal Trade Commission. That’s about one of every four dollars reported lost to fraud. And crypto hacks are on the rise. Last week, a hacker attacked the Discord server for the Bored Ape Yacht Club and made off with 200 ether (or $360,000) worth of the non-fungible apes. And the NFT sales platform OpenSea is facing backlash for security vulnerabilities. Wanna keep your NFTs and coins safe? We Skimm’d how to store, save, and spend your crypto safely.

Thing to Know

Gas Tax Holiday

No PTO required. Gas prices are straining Americans’ budgets. (Hint: The average price is currently around $5 per gallon.) So four states — Connecticut, Georgia, Florida, and New York — are saying ‘take a break’ by temporarily suspending gas taxes. Which can add up, but don’t expect it to pay for your next Sephora haul. (Psst…the average state gas tax is about 30 cents per gallon.) Even if your state isn’t saying ‘take a tax vacay,’ you can still save. Shop around with gas apps to find the best price and budget for higher prices. Skimm more about gas tax holidays and other ways to save.

Hot Off the Web

Don’t blame Amy Schumer. Inflation is making your period more expensive.

Getting furniture from Craigslist? At worst: bed bugs. At best? $36,000.

Working from home might not be saving you as much money as you think.

Your international vacay may get a little easier (and cheaper). The Biden admin is dropping the negative Covid-19 test requirement for travelers flying to the US.

These last-minute Father’s Day gifts (starting at less than $7) can help you thank the dad figures in your life for their perfect jokes and shoe inspo.

Subscribe to Skimm Money

Your source for the biggest financial headlines and trends, and how they affect your wallet.