Hey hey.

This week, we’re bringing you a special edition Skimm Money all about crypto. From the latest trends in digital currency to Skimm'tionary terms you need to know to make sense of it all. Psst...don’t miss the special announcement below in Asking for a Friend. Hint: you’ll want to mark your cal for August 10.

Crypto Trends, Skimm'd

All aboard: Businesses, banks, and entire countries are increasingly embracing crypto. Last week, JPMorgan became the first big US bank to allow all of its wealth-management clients to trade certain crypto funds. In June, El Salvador adopted Bitcoin as legal tender (raising some eyebrows). And more companies, including Newegg and CheapAir.com, are now accepting it as payment.

Regulating the unregulated: Crypto is decentralized, aka not backed by a gov or other authority. But that's not stopping govs from stepping in with their two cents. Lawmakers in the US and around the globe are calling for a crypto crackdown, citing a lack of transparency, security risks, and volatility as causes for concern.

Eco-unfriendly: One study estimated Bitcoin mining consumes more energy per year than Colombia or Bangladesh. That carbon footprint has made some companies walk back their support for crypto. And led some places to stop mining in its tracks.

A bumpy ride: Bitcoin's price peaked near $65,000 in April. Sank below $30,000 in mid July. Then briefly hit a six-week high of $40,000 just this week. Dizzy? Experts say, 'get used to it.'

Govs consider a DIY version: Some countries (see: China and maybe the US) are adding a little spice to the crypto craze and working on their own digital currencies. Potential added features: gov control, trackability, and less anonymity.

Famous crypto stans: Elon Musk. Jack Dorsey. Cathie Wood. Mark Cuban. Snoop Dogg. Ashton Kutcher. Mike Tyson. And Lindsay Lohan.

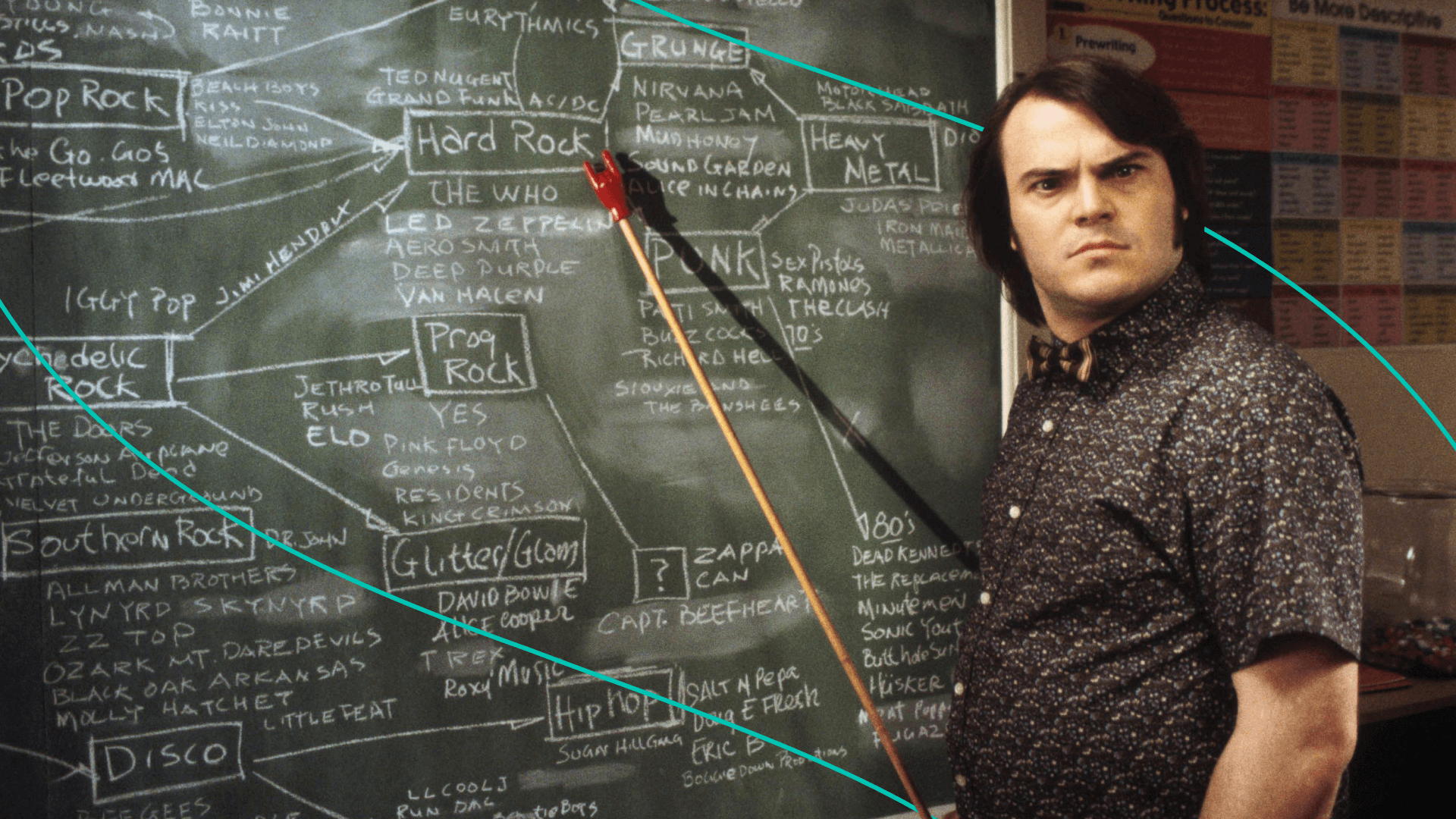

Skimm'tionary

Ready to chime in on crypto group chat? We Skimm’d important crypto terms to know here. A couple icebreaker ideas: Who really created Bitcoin? Is Dogecoin still a joke, or should we take it seriously now?

Make Good (Money) Choices

If you’re feeling FOMO over crypto...

Ask yourself a few Qs before diving in. Because, before you buy anything, quizzing yourself about whether it's really worth it – aka spending with intention – helps ensure you're in control of your money. When it comes to crypto specifically, here are some things to consider when trying to figure out your answer to one of the biggest crypto questions...

If your answer to the above was "go for it"...

Explore your options for how (and where) to buy, store, and spend crypto. A popular place to buy and sell crypto is on an exchange, like Coinbase, Gemini, and Binance. You'll also need a crypto wallet to keep your digital money secure. You can go with a hot wallet (linked to the web) or a cold one (stored offline). If you'd rather spend your Bitcoin, Ether, Litecoin or other crypto, you can connect it to a crypto debit card. Or your PayPal account, which you can use to check out at retailers that accept crypto, like Overstock and Expedia.

If you're puzzled by blockchain…

Let us help you put the pieces together. Blockchain is basically a digital database that works kind of like high-tech Legos. Each block contains a unique set of data, including a locked-in timestamp of when it was added to the chain. Read: hard to hack. Bitcoin and other kinds of crypto use the tech as a digital ledger to publicly record and verify transactions. How else can blockchain be put to good use? Skimm'd it for you here.

If you're wondering why Bitcoin's been called "digital gold…"

Think: inflation. That's the general rise in the cost of goods and services that causes your dollars to lose purchasing power over time. When inflation picks up, people may turn to investments expected to hold steady or even increase in value. A big one: gold. And, some say, maybe Bitcoin. Because, like gold, it's finite (there's a cap of 21 million bitcoins) and not tied to a monetary policy. As in, no one can increase the supply – like the Federal Reserve can with US dollars to help the economy grow, which can lead to inflation. Bitcoin's first inflation test is happening now.

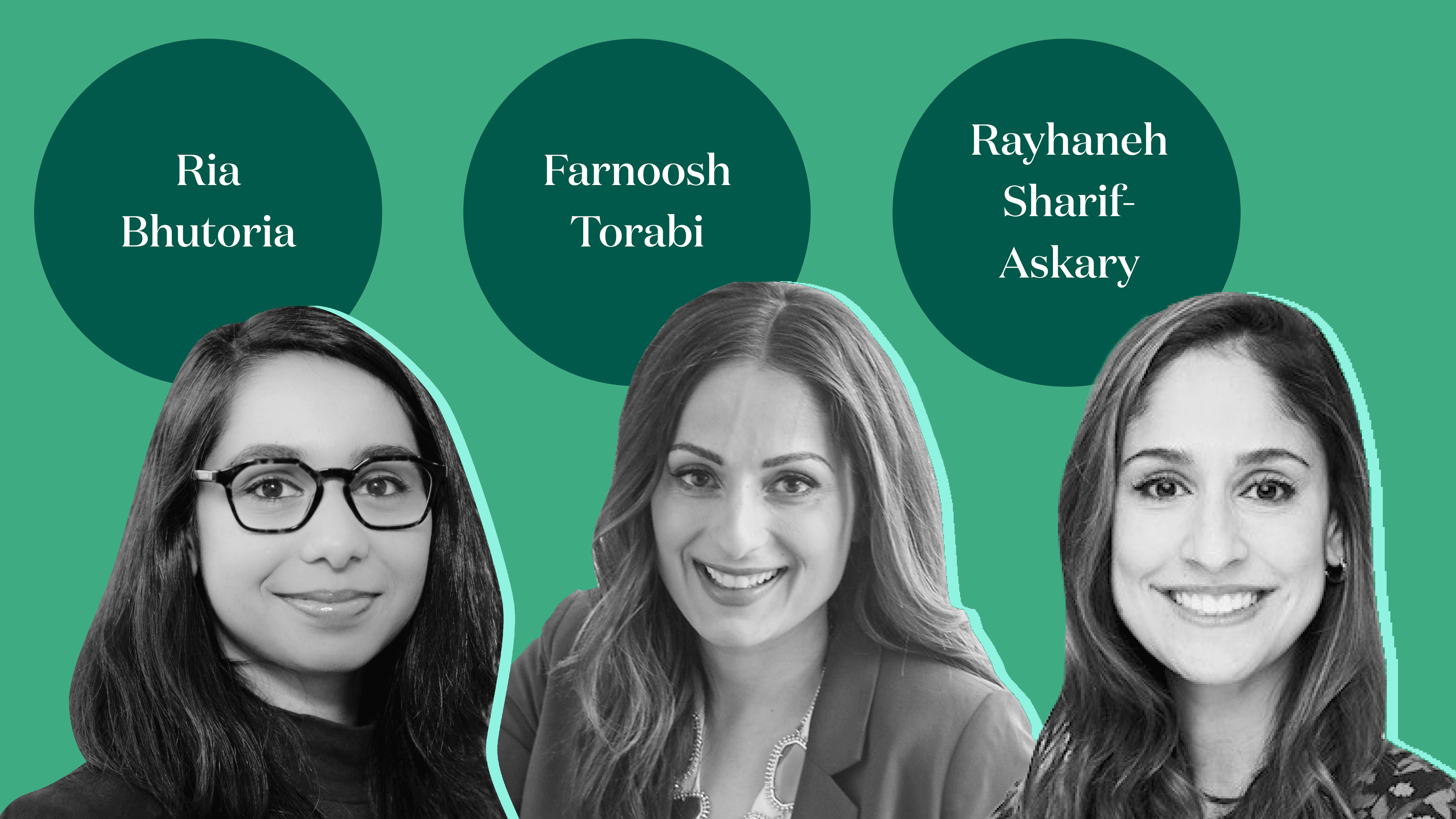

Asking for a Friend

There are a lot of different opinions out there about crypto. So we’ve asked these three experts to join us on August 10 for SkimmU Special Edition: Crypto, presented by Grayscale Investments, to share theirs. And answer your crypto Qs. It’s gonna be good. RSVP to save your seat. Psst...it's free.

Q: Crypto's not new, but it's been dominating headlines this year. Why are people crazy for crypto now?

Rayhaneh Sharif-Askary, director of investor relations and business development at Grayscale Investments: Crypto has become a legitimate part of investors’ portfolios. It’s now almost as easy to own crypto as it is to own stocks. The space itself has also matured exponentially, with significant mainstream investment and adoption. On the macro front, fears around the long-term impact of the monetary stimulus associated with the government’s response to COVID have caused the investment community to believe that resulting inflation may prove Bitcoin is the safe haven asset we have always believed it would become. Today, the question to answer is no longer "why invest?" but "why not?"

Q: A lot of experts say crypto's here for good. What gives it staying power?

Ria Bhutoria, principal at Castle Island Ventures: Crypto has staying power because such a vast and growing global community is willing to weather the industry’s volatility. That's because the community resonates with the ethos of building decentralized, censorship resistant, open networks and applications that will eventually be accessible by everyone, everywhere.

Q: Some retirement accounts now offer crypto. What should you know before adding some to your portfolio?

Farnoosh Torabi, financial author and host of the "So Money" podcast: It's key to remember that this is an alternative asset class, one that's yet to have historical or quality data like the traditional stock market. It's also super risky. That doesn't mean we need to stay away from it entirely, but proceed with caution. If you really feel the desire to invest, sprinkle it in – no more than 10% of your overall diversified portfolio.

These responses have been lightly edited for length and clarity.

Hot Off the Web

Dept of Justice problems: what do we do with all this seized Bitcoin?

Bitcoin miners also work from Starbucks sometimes.

Women and people of color are more likely to trade crypto vs. stocks.

An unexpected risk: crypto addiction.

What else you can do with crypto: donate it. But it's complicated.

Subscribe to Skimm Money

Your source for the biggest financial headlines and trends, and how they affect your wallet.