Martin Luther King Jr.'s dream included economic equality for everyone. And while we’ve made some progress, there’s still a racial wealth gap to close. You can honor MLK Day on Monday by helping in your community or giving to orgs that are still working to reach his goals.

Headlines, Skimm'd

No winter break for inflation. In December, the Consumer Price Index (hint: it measures the average prices of goods and services over time) rose 7%* from the previous year — its biggest jump since 1982. Prices on used cars and housing went up the most while energy costs actually came down. The uptick in prices (and shortages) helped lead consumers to spend less in December: retail sales dropped 1.9% from November. How’s the gov responding to inflation? Fed chair Jerome Powell told lawmakers at his Senate confirmation hearing that he’s ready to push back with policy. So mark your cal: rate hikes are expected to start in March.

The big ‘O’ takes America OOO. An estimated 5 million workers called out sick this week due to COVID-19 infections, driven by Omicron. That's forcing businesses nationwide to cut back services and operating hours. And staffing shortages are expected to continue disrupting the economic recovery — and your life — for months to come. So expect more flight cancellations, restaurant closures, and delays for returning to schools and offices.

Testing, testing (for free). Starting tomorrow, private health insurers must cover costs for up to eight at-home COVID tests per person every month. Policyholders can get free tests through their plan’s preferred pharmacy or retailer, in-person or online. Or get reimbursed for tests purchased out-of-pocket elsewhere. The gov also pledged to send 10 million free tests per month to schools* and another 500 million directly to Americans upon request, both starting later this month.

*PS: Not a Washington Post subscriber? Check out their exclusive offer just for Skimm’rs.

News to Wallet

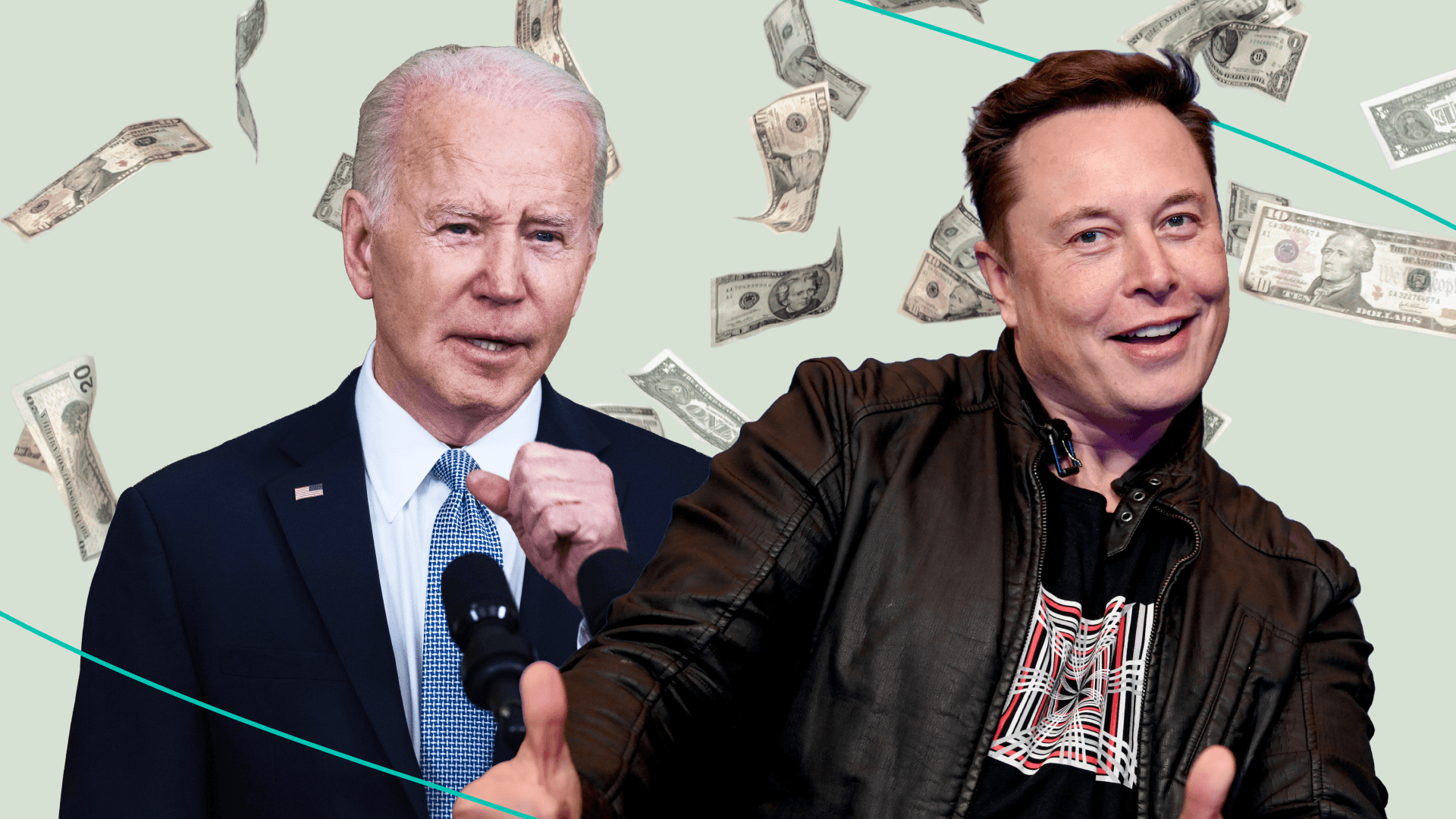

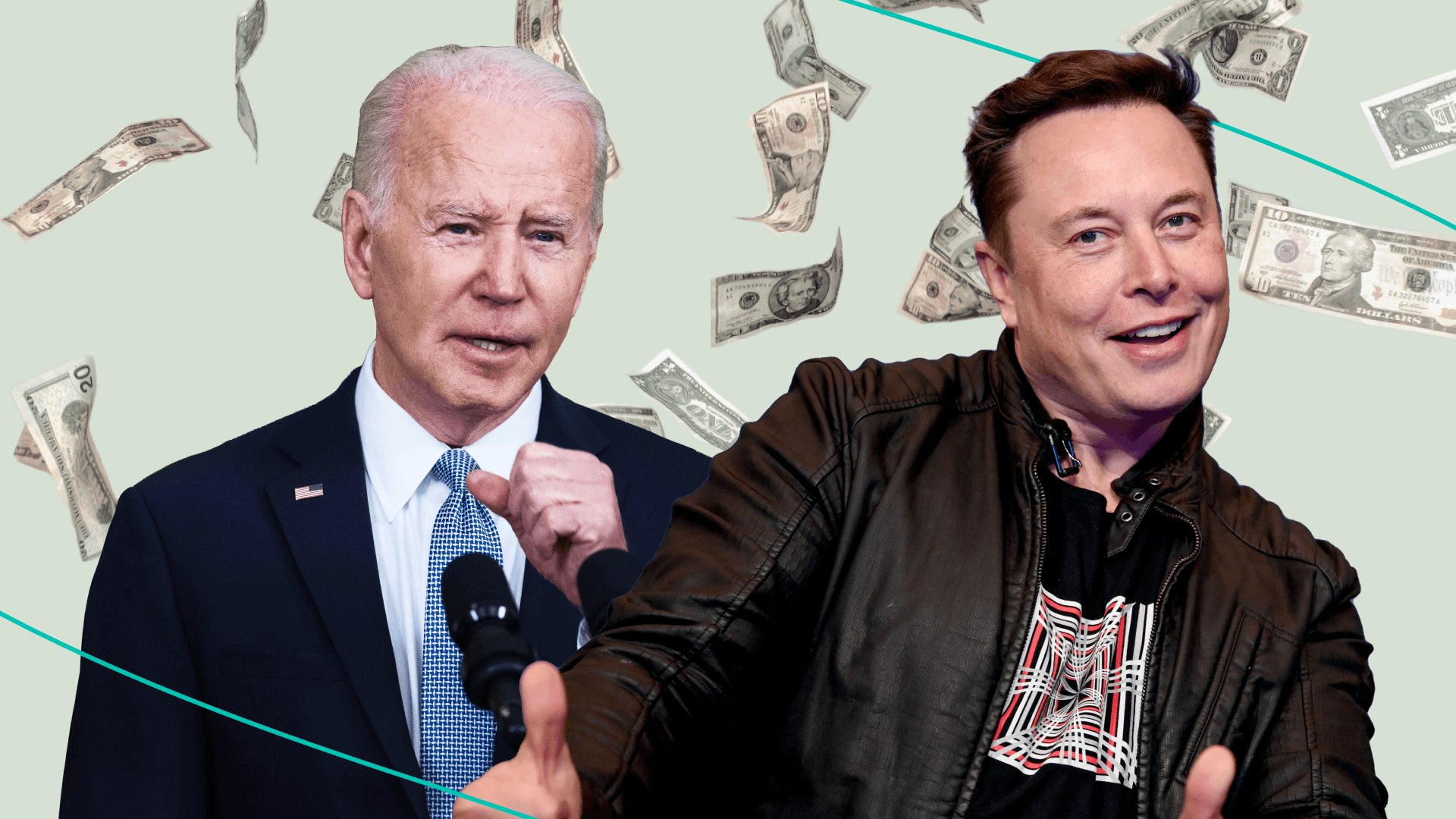

How Political Drama Can Affect Your Wallet

What happens in Washington definitely doesn’t stay there. And politics can impact your wallet as much as it can disrupt your Twitter feed. Example: arguing over the Build Back Better bill has left Americans waiting on benefits like paid family leave, free pre-K, and expanded health care coverage. And internationally, Russia-Ukraine tensions are helping push up energy prices. You may not be able to control world leaders' decisions, but understanding how they can impact your money can help you financially prep for all the drama, drama, drama.

Make Good (Money) Choices

If you’re ready to break up with your budget…

Give it another shot. Because there’s more than one way to budget. And finding the approach that fits your lifestyle and abilities is the key to sticking with it. One popular option: follow the 50/20/30 rule. It has you put 50% of your money toward your needs (think: rent, basic groceries, and minimum debt payments), 20% to savings, and 30% to everything else. Get more ideas for making a budget you don’t hate and taking control of your money.

If your credit card’s APR hasn’t piqued your interest…

Look it up. A new survey found 40% of Americans with credit card debt don’t know their interest rate. But learning it can help you set smart money priorities. Like paying off your card faster, because rates are expected to go up this year. One strategy that can help: the avalanche method, aka chipping away at your highest-rate debts first to limit those big interest charges.

If you do a lot of business on Venmo…

Say ‘hi’ to the IRS. A provision in the American Rescue Plan aims to crack down on tax avoiders and beef up tax revenues. So as of January 1, payment apps like Venmo, PayPal, Cash App, and Zelle are required to report commercial transactions totaling more than $600 per year to the IRS. Key word: commercial. So don't worry about your roommate’s rent payment. But freelancers and gig workers who get paid through such apps can expect Uncle Sam to be watching. Remember: you’re supposed to report any profits over $400 when filing self-employment taxes anyway. Oh, and you might want to file ASAP. The IRS is drowning in paperwork, which could spell refund delays.

Crypto, Decoded

Haaaaave you met Bitcoin? The OG crypto just turned 13. To celebrate, here are three fun facts about it:

Bitcoin is a type of digital currency that's not backed by any central authority (like how the US dollar is backed by the gov). Instead, it runs on a system of peer-to-peer networks known as blockchain.

It was created in 2009 by a mysterious person(s?) under the pseudonym Satoshi Nakamoto. To this day, no one really knows who they are…even as Australian entrepreneur Craig Wright says, 'it me.'

Bitcoin's value is about as stable as a middle school relationship. Read: it's volatile. In January 2020, it was topping just $9,000. In October 2021, it hit a record high of about $66,000. And on Monday, it dropped below $40,000 for the first time since last September, giving it the worst start to a year since the early days of crypto.

Still have Qs? Skimm what it is and how it works in our bitcoin basics guide. Or watch 2017 Hank Azaria explain it from a bathtub.

Hot Off the Web

Senators from both parties want to ban insider stock-trading in Congress — and introduced separate bills to do it.

Bumper stickers are out, NFTs are in for political fundraising.

Major change: Maya Angelou became the first Black woman on a US quarter.

Bank of America cut overdraft fees from $35 to $10 and nixed insufficient fund fees.

A lawsuit alleges top universities colluded on a financial aid price fix.

Spending more time at home (again)? Here are 17 games, puzzles, and cards to stay inside with.

Subscribe to Skimm Money

Your source for the biggest financial headlines and trends, and how they affect your wallet.