We Skimm'd more taxes topics for you...

The story

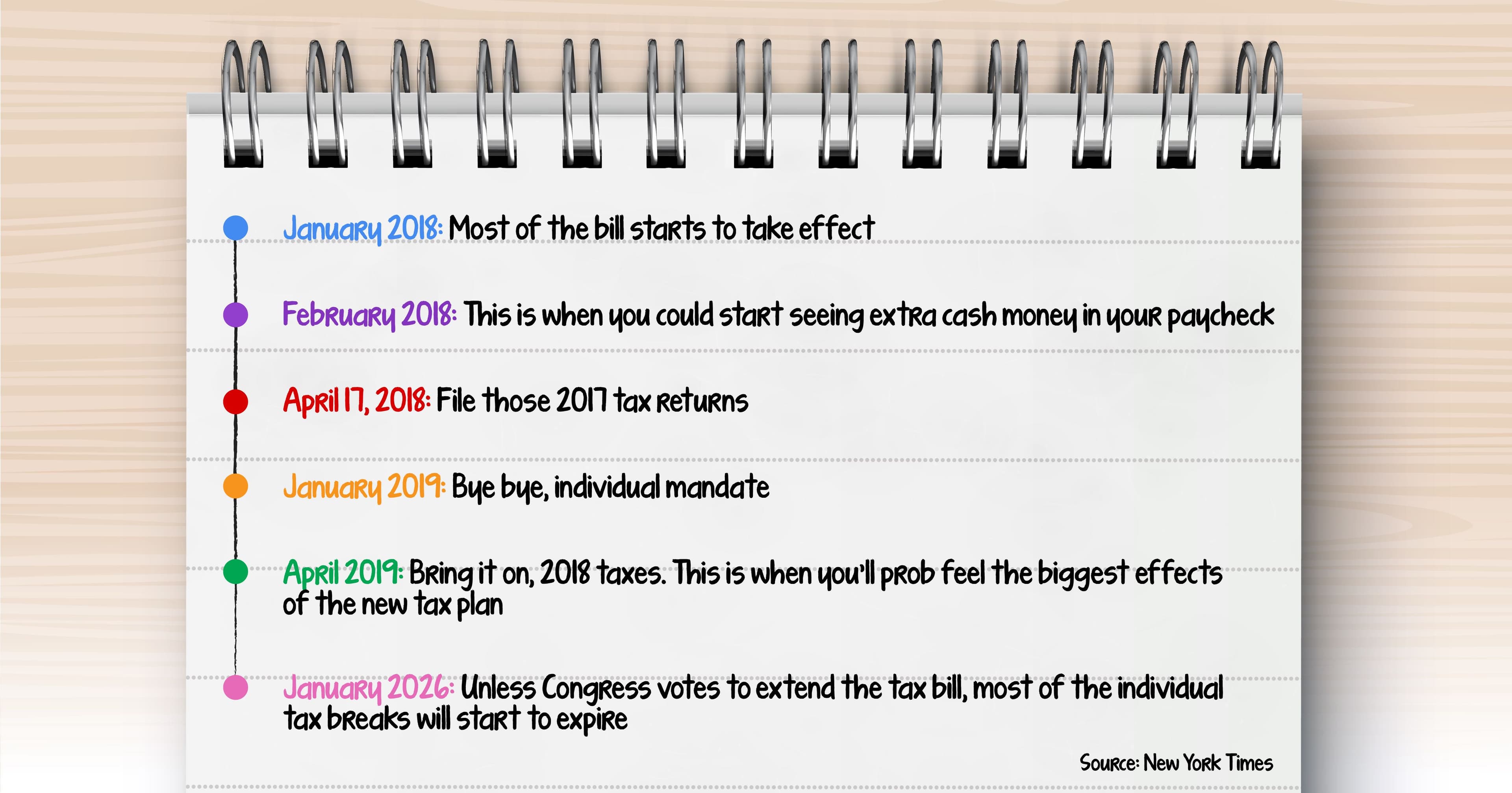

You’ve been hearing a lot about the new tax plan. Parts of it will probably affect you this year (think: your paycheck). And other parts probably won’t affect you until next year (think: your tax returns).

What's the timeline?

Why?

Here’s how tax filing works: every year, you file taxes on what you made the year before. So this year, you’re filing 2017 taxes. The new GOP tax plan officially kicked off in January 2018 – so it’ll affect the 2018 taxes you’ll file next year.

What do I need to know for next year?

A lot. Here are a few things…

Mortgage: If you bought a house this year or plan to buy one soon, you’ll be able to write off up to $750,000 from the interest on your mortgage. The old tax plan let you deduct up to $1 million. But the old rule still applies if you bought a house before Dec 15, 2017.

Health care: Say goodbye to that tax penalty you have to pay if you don’t have health insurance. The Obamacare individual mandate goes away in 2019, so you won’t have to pay a fee when you file your 2019 taxes.

SALT: Not just what you put on food. Stands for state and local taxes on property, income, and sales. You can still deduct these kind of things when you file your taxes. But only up to $10,000. It’s a major blow to people living in states with high taxes (looking at you, NY and CA).

Child tax: For once the more kids you have, the merrier on your wallet. You can get up to a $2,000 tax credit for each kid that qualifies. That’s twice as much as the last tax plan.

Moving: If you’re packing up and moving for work, you can’t deduct any expenses. Unless you’re in the military.

What's happening this year?

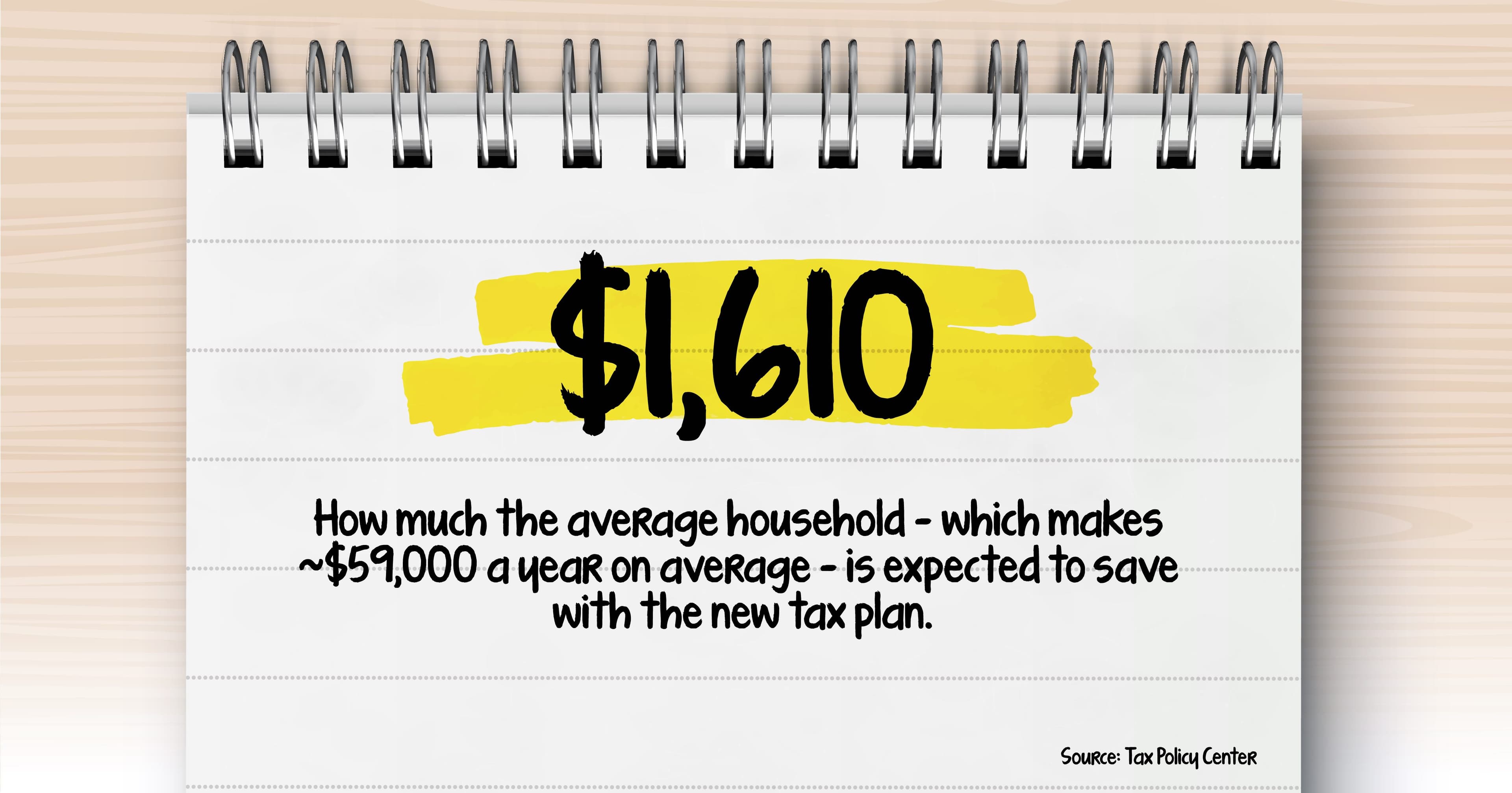

Notice a bump in your paycheck recently? Most people are expected to get one. And you have that new tax plan to thank. That’s because it changes the tax brackets – aka how the gov decides how much to tax you based on your salary. So most people don’t have to cough up as much to the gov. But it’s not all rainbows and unicorns.

Why's that?

Paying less in taxes may mess up your withholdings – how much your employer takes out from your paycheck for federal taxes. The IRS has some new guidelines based on the new tax brackets. But if your employer doesn’t make the right changes for you, they may take out too much or too little. Meaning: you might have to pay The Man in 2019. Check in with your HR manager for more on that.

What else?

Here are a few things that Congress decided not to touch in the new bill…

Student loans: Stay in school, kids. If you’re still paying off your loans, you can still take out up to $2,500 from the interest on your returns.

401(k): One way to save up so you can retire. The new tax code doesn't change the amount of pre-taxed money you can put in it. Happy retirement.

So are these changes good for me?

Depends. Supporters say this will help people get more cash in their wallets, so get pumped. Critics say these tax cuts could add a looot of money to the deficit. And even though you’re getting a tax cut now, it might not last.

Why?

None of this is permanent. Most of the individual tax breaks in this new law expire after 2025. Then it will be up to Congress whether to say ‘aye’ on keeping them around for longer.

theSkimm

Times they are a changin’. Now you know what those changes look like so there aren’t any surprises when you sit down to file next year. Get to it.*

*PS: This is an affiliate partner, which means if you buy anything, theSkimm may get some cash money. Thanks.

Subscribe to Skimm Money

Your source for the biggest financial headlines and trends, and how they affect your wallet.